Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

The disappearing inventory

SoCal home prices are up a solid 12.5 percent year-over-year. With incomes being stagnant you need to ask where this jump in price is coming from. Two main places:

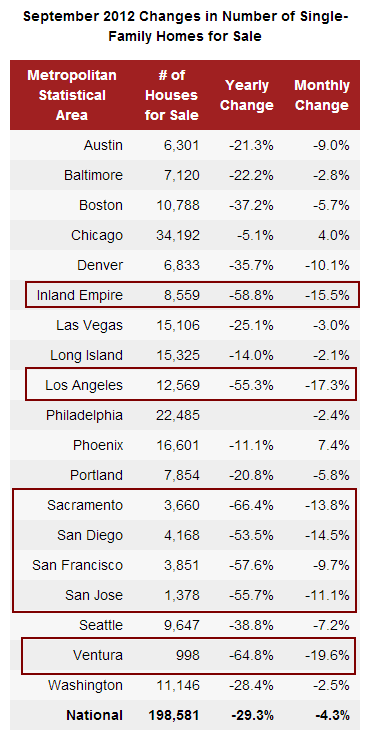

-1. Low inventory selection (also decline of distressed inventory as percent of sales)This is also a nationwide trend but inventory in California has virtually disappeared:

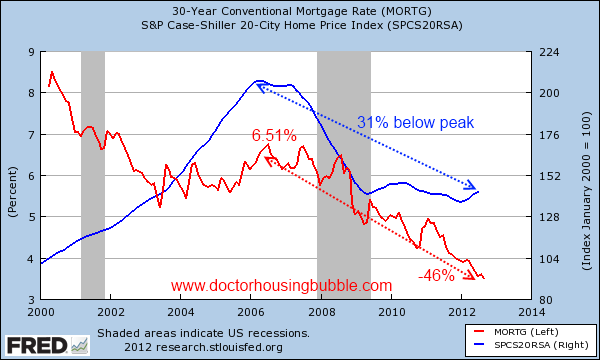

-2. Incredibly low interest rates

Source: Redfin

How crazy is this? Nationwide inventory is down 29 percent but in some places like Ventura County it is down a whopping 64 percent! Constrain supply like this and it is no surprise why prices are rising. Those willing to buy are dealing with a small selection of properties but also competing with Wall Street for these homes. California inventory is down from 53 to 66 percent year-over-year depending on what metro area you are looking at. This is dramatic. Compare this to say Chicago where the number of homes for sale is virtually flat year-over-year.

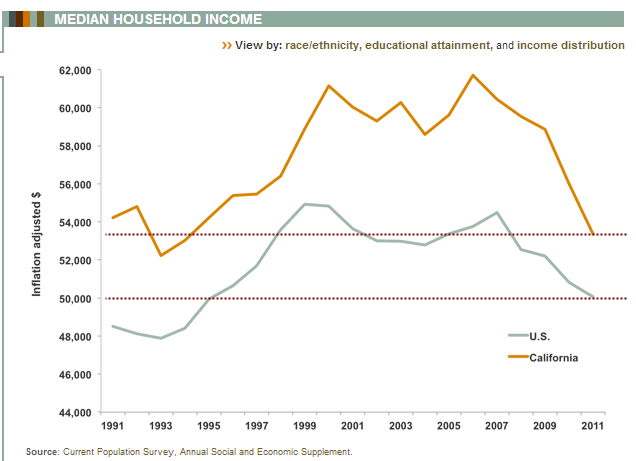

With that said, let us take a look at household income in the state:

California household incomes adjusted for inflation are back to levels last seen in 1993. This trend is a nationwide issue. Logically all of this makes sense to people. Many even understand the complicated motivations of the Fed with QE3 and understand that this market is completely controlled. Yet housing plugs into a very deep psychological need for belonging and many people feel a deep need to set their roots. For some, a mortgage is prerequisite for feeling established. I’ve gotten a few e-mails that go along these lines especially over the summer:

“Dr. HB. We’ve been waiting many years on the sidelines waiting for the right time to buy. It is absolutely frustrating that prices in [insert hipster/mania neighborhood] are going out of control again! Prices are near peak levels again and I simply cannot wait any longer.”Cognitive dissonance is a tough pill to swallow. Markets are largely irrational and it is hard to even say that our real estate market is operating in a market system:

-Federal Reserve pushing rates into negative territory (QEI, QEII, QEIII, TARP, Operation Twist etc)I can understand the frustration but if you feel this strongly that you need to own then why not buy? The Fed is actually betting that you will. Yet for a place like SoCal especially in many prime areas the pickings are slim and the prices are outrageous. It is interesting because it is now even becoming competitive in more select locations in the Inland Empire to buy.

-FHA insured loans

-Fannie Mae and Freddie Mac

-Mortgage interest deduction

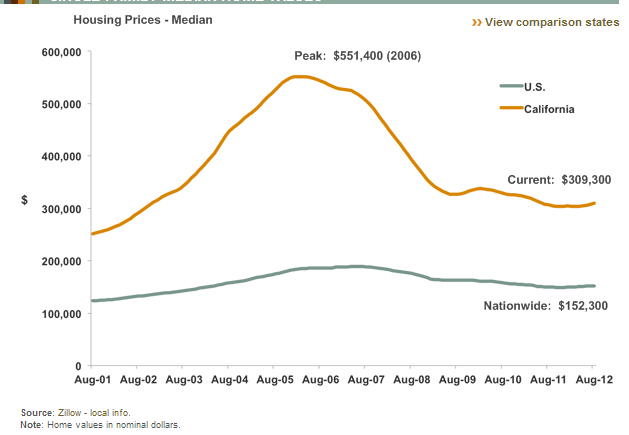

Let us take a look at overall home prices in the state:

Not bad especially in many regions. Yet many that have solid incomes want to buy in areas experiencing manias. It is an interesting experience getting to see another mania unfolding. We saw a little bit of this with the first time home buyer tax credit but that certainly did not have the impact of the current environment:

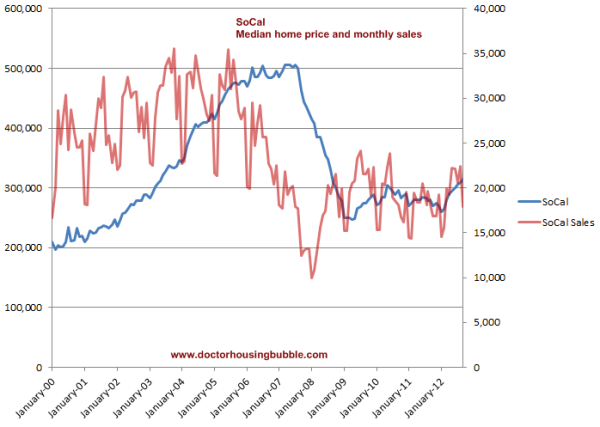

When we look at the overall market however for SoCal, we see sales are up but nothing that would signify a rise of 12.5 percent in median price over the year:

This is another interesting dynamic. Last month, 16 percent of SoCal sales were foreclosure resales. This is way down from the peak of 56 percent. So this is also tilting the median price much higher. So what you have is a market with limited inventory, big demand from investors, and incredibly low interest rates. All three of these are perfect recipes to push prices higher in the short-term. Is this sustainable long-term? It is hard to see this being sustainable unless wages keep pace. For the time being it is no surprise that the Fed is back to setting the stage for another housing bubble. The fact that home prices are up 12.5 percent in SoCal over the last year should tell you something.

So bringing all of this together, it is no surprise to me that many of those actively in the market to buy today must feel like we are reigniting another housing bubble. The frustration is clear but it is also coming from groups like real estate agents that have limited inventory to sell. Some key figures do stand out from last month for SoCal:

FHA insured buyers: 25 percentOver half the market is driven by low down payment buyers squeezing in and another 31 percent are investors (big cash especially for California). The rate of flipping is also increasing. For those looking to buy, this is the market you are heading into. Does it make economic sense? Of course not and most of this is behaviorally driven but this is part of living in an area prone to boom and bust (for those that remember the late 1980s and early 1990s and 2000s). Understanding this may help you to learn to love SoCal just a little bit more.

All cash buyers: 31 percent

Article Via: http://www.doctorhousingbubble.com

Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

No comments:

Post a Comment