Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

|

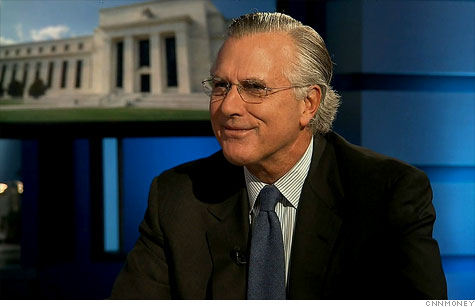

| Richard Fisher, president of the Dallas Fed, owns more than 7,000 acres of land and $1 million in gold. |

One Fed official owns thousands of acres of farmland and at least $1 million in gold. Many own individual blue chip stocks, while another appears to hold no major assets other than his home and an employee benefit plan.

Americans got an unprecedented peek at the wealth of the Federal Reserve's top ranks this week, when the central bank released nearly 600 pages of financial disclosure documents from its current regional presidents.

The Fed released financial disclosures for Chairman Ben Bernanke and the Fed Governors last year, but this is the first look at the wealth of the Fed presidents. As the heads of the Fed's regional banks, these 12 officials have a say in the central bank's decisions on monetary policy and play a key role in regulating the financial industry.

Unlike Bernanke, whose assets were in no-frills retirement accounts, money markets and U.S. Treasury securities, several top Fed members have more interesting investments.

Richard Fisher, president of the Dallas Fed, is one of the richest of the 12. He accrued a portfolio of at least $21 million after working 22 years in the financial industry as a banker, stock broker and hedge fund manager.

Fisher owns more than 7,000 acres in Texas, Georgia, Iowa and Missouri, in addition to more than $1 million in SPDR's Gold Trust (GLD), and at least $50,000 in platinum and uranium each.

He also holds common stock in at least 43 companies, including more than $500,000 in Google (GOOG, Fortune 500).

Some of the other presidents' investments are more plain vanilla.

Minneapolis Fed President Narayana Kocherlakota invested in index funds and some savings bonds. Richmond Fed President Jeffrey Lacker has little other than a checking account at Bank of America (BAC, Fortune 500) and less than $50,000 in a money market mutual fund.

Eric Rosengren, of the Boston Fed, owned shares of Jetblue (JBLU), Intel (INTC, Fortune 500) and Pfizer (PFE, Fortune 500).

Atlanta's Dennis Lockhart recently had stock in Apple (AAPL, Fortune 500), Amazon (AMZN, Fortune 500), Boeing (BA, Fortune 500), Coca-Cola (KO, Fortune 500), eBay (EBAY, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Oracle (ORCL, Fortune 500), just to name a few.

Meanwhile, James Bullard, president of the St. Louis Fed, filed a form that revealed some things, such as outside organizations he is involved in, but said nothing about his assets. The St. Louis Fed's ethics officer said Bullard's investments -- like his home and his holdings in an employee benefit plan -- did not fall under the disclosure requirements.

Beyond the basic holdings are a few curious situations.

About two weeks ahead of the Fed's decision in November 2010 to launch a major stimulus program known as QE2, Lockhart put about $289,000 in index funds tracking the Russell 1000 (IWF) and S&P 500 (SPX), and another $47,000 in a Vanguard emerging markets fund.

Stocks went on to rally following the announcement of the $600 billion stimulus plan. His disclosure form indicates he held the investments at least through the end of 2010.

Like many other Fed presidents, Lockhart's assets are managed by a third-party firm. An Atlanta Fed spokeswoman said that Lockhart holds a combination of assets, some of which he directly controls and others which he does not.

Fed employees, like all employees at other government agencies, are restricted from owning shares of companies that they regulate, said Craig Holman government affairs lobbyist for Public Citizen.

Fed presidents are also restricted from selling or buying securities of any kind during the seven days both before the central bank's policymaking meetings.

Philadelphia's Charles Plosser was found in violation of that rule in 2007, when he transferred money into mutual funds that he held jointly with his children. Fed letters show that once he realized the error, he notified the Fed's lawyers, and the mistake quickly prompted the central bank to remind its officials about the blackout period at subsequent meetings.

Fed official owned shares of AIG and General Electric

New York Fed President William Dudley's assets are perhaps the most controversial, after an investigation by the Government Accountability Office last year revealed a few potential conflicts of interest.

Among Dudley's assets were 500 shares of AIG (AIG, Fortune 500) and 4,500 shares of General Electric (GE, Fortune 500) that he owned while the Fed was negotiating emergency aid for the insurance giant and the broader financial industry.

He had acquired the assets before joining the Fed, and by the time the central bank began to weigh measures to assist the financial services industry, it was considered inappropriate for him to sell those shares because of the inside information he possessed.

The Fed instead decided to make him sell the shares at a random date in the future. Dudley unloaded the AIG shares in 2010 and the GE shares in 2011.

Overall, the financial disclosures don't necessarily offer a complete picture of each Fed member's total worth.

Dudley, for example, at first appears to own a minimum of $8.6 million in assets. But after the Fed also said Dudley's $1.45 million in TIPS amount to less than 5% of his assets, it's clear his portfolio is worth at a minimum, $29 million.

Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

No comments:

Post a Comment