Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

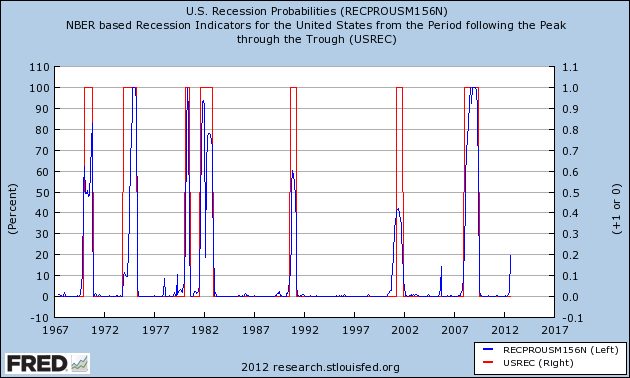

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

Interestingly, I still don’t see recession in my internal indicators. Those indicators have been right for a long time now (in the face of some very public recession predictions by reputable people). So I am afraid when my internal indicators point to “no recession” when an indicator like this clearly puts that opinion in the “this time is different” category….

“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. “What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index.

Interestingly, I still don’t see recession in my internal indicators. Those indicators have been right for a long time now (in the face of some very public recession predictions by reputable people). So I am afraid when my internal indicators point to “no recession” when an indicator like this clearly puts that opinion in the “this time is different” category….

Article Source

Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

No comments:

Post a Comment