Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

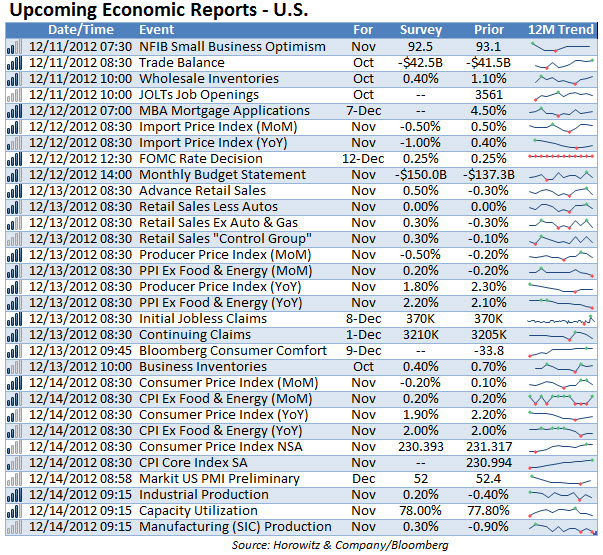

After the “amazing” jobs report on Friday, investors will be quite

curious to see the response from the Fed. On Wednesday, Mr. Bernake will

provide a rate decision and further details about the state of the

economy. The question that we all want to know is if the pace of the

recent jobs data will sway the Fed from further easing. Bets are that it

will not in the least.

Other that that , retails sales numbers are expected to stay flat with the previous month as is the CPI. Inventories have been on the rise of late. While this is good for GDP numbers, we will have to watch the inventory-to-sales ratio to see exactly if the increase is due to additional orders or otherwise. With manufacturing slowing, it would seem that orders are also on the decline.

Article Source: TheDisciplinedInvestor

Other that that , retails sales numbers are expected to stay flat with the previous month as is the CPI. Inventories have been on the rise of late. While this is good for GDP numbers, we will have to watch the inventory-to-sales ratio to see exactly if the increase is due to additional orders or otherwise. With manufacturing slowing, it would seem that orders are also on the decline.

|

| US Economic Report |

Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.