Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.

Via a recent media blitz,

ECRI Co-Founder Lakshman Achuthan insists that the US is already in

recession, apparently as of July. I would be very skeptical that this

was in fact the case. I think the preponderance of evidence weighs in

favor of ongoing expansion, disappointing as the pace of that expansion

may be.

Actually, Achuthan loses credibility quite quickly by claiming there is a strict definition of recession based upon peaks of production (Achuthan apparently views “production” as “industrial production”), income, jobs, and sales. In contrast, according to the NBER business cycle dating committee:

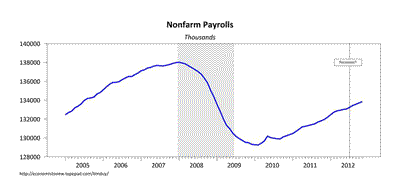

No, nothing to see here. Unless you expect some very, very significant revisions, nothing in the jobs picture should lead you to believe that a recession began in July. I find it very hard to believe that the NBER would find cause to declare a recession began in July when the economy added jobs for the next four months. How about real income?

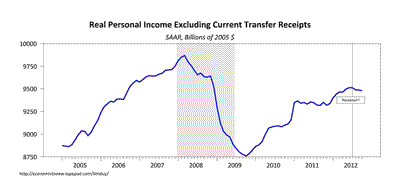

Arguably, there is a peak in July. There was, however, also a peak at the end of 2010 as well, and real income moved sideways for almost a year, yet no recession was identified in 2011. In other words, recent behavior in this series is not inconsistent with that seen during the current expansion.

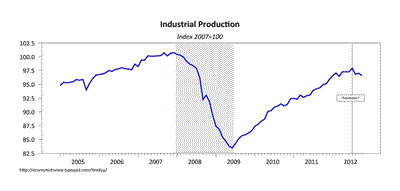

Together, I don’t think these four indicators even begin to pass the sniff test for dating a recession beginning in July 2012. Beyond what the NBER believes to be the key elements in identifying recessions comes secondary data that does not cover the entire economy. Start with industrial production:

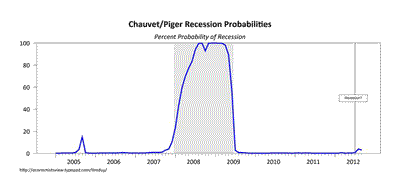

I think that even a cursory glance of all the data the NBER cites as elements in recession dating, even ignoring the important issue of first identifying broad-based indicators, would lead one to be very skeptical about a July recession call on the basis of “eyeball econometrics” alone. Moving on to something more sophisticated, Chauvet and Piger (1998) use the four variables identified by Achuthan to estimate recession probabilities:

Article Source: WallStreetPit

Actually, Achuthan loses credibility quite quickly by claiming there is a strict definition of recession based upon peaks of production (Achuthan apparently views “production” as “industrial production”), income, jobs, and sales. In contrast, according to the NBER business cycle dating committee:

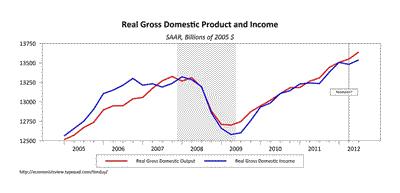

The Committee does not have a fixed definition of economic activity. It examines and compares the behavior of various measures of broad activity: real GDP measured on the product and income sides, economy-wide employment, and real income. The Committee also may consider indicators that do not cover the entire economy, such as real sales and the Federal Reserve’s index of industrial production (IP). The Committee’s use of these indicators in conjunction with the broad measures recognizes the issue of double-counting of sectors included in both those indicators and the broad measures. Still, a well-defined peak or trough in real sales or IP might help to determine the overall peak or trough dates, particularly if the economy-wide indicators are in conflict or do not have well-defined peaks or troughs.Dating a recession, it would seem, is something of an art. And note that Achuthan appears to ignore the role of GDP and GDI in the determination of a recession. Taking a quick look at those two series:

(click to enlarge)

Both GDP and GDI gained in the third quarter. I would imagine that

the NBER would need to see at least one of these indicators clearly turn

downward before the issue of recession would even be worth the

slightest consideration. Onto the jobs picture:No, nothing to see here. Unless you expect some very, very significant revisions, nothing in the jobs picture should lead you to believe that a recession began in July. I find it very hard to believe that the NBER would find cause to declare a recession began in July when the economy added jobs for the next four months. How about real income?

Arguably, there is a peak in July. There was, however, also a peak at the end of 2010 as well, and real income moved sideways for almost a year, yet no recession was identified in 2011. In other words, recent behavior in this series is not inconsistent with that seen during the current expansion.

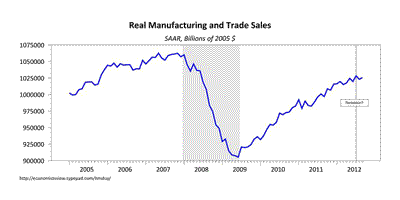

Together, I don’t think these four indicators even begin to pass the sniff test for dating a recession beginning in July 2012. Beyond what the NBER believes to be the key elements in identifying recessions comes secondary data that does not cover the entire economy. Start with industrial production:

(click to enlarge)

There is clear evidence that manufacturing softened in recent months,

consistent with the July near-term peak in industrial production. As

the NBER notes, however, a downturn in one sector does not define a

recession. A recession is a broad-based downturn in activity;

industrial production may be an element in dating a cycle, but is not

itself a recession. Next up is real manufacturing and trade sales, only

available through September:

(click to enlarge)

I would be hard pressed to call July a peak. It looks like this

series rolls over quickly in a recession, coincident with a jobs

downturn. And that, I believe, is the key – you don’t see widespread

declines of activity without widespread job losses. And when job losses

mount, sales roll over. I very much doubt sales will roll over in the

presence of ongoing job growth. They may bounce along sideways – see

2006. But decline substantially and persistently? Doubtful, in my

opinion. Watch, however, for recession watchers to take an October,

Katrina-impacted decline as recession evidence.I think that even a cursory glance of all the data the NBER cites as elements in recession dating, even ignoring the important issue of first identifying broad-based indicators, would lead one to be very skeptical about a July recession call on the basis of “eyeball econometrics” alone. Moving on to something more sophisticated, Chauvet and Piger (1998) use the four variables identified by Achuthan to estimate recession probabilities:

(click to enlarge)

When first released, this measure stirred up some excitement as some interpreted the original 20% estimate for August to be a clear signal of recession. As Jeremy Piger notes on his website:Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion.In any event, the estimate was subsequently revised downward, and now indicates only marginal probability of recession.

Article Source: WallStreetPit

Sign up before Midnight to watch our video,

“Biggest Ponzi Scheme in U.S. History to Crash,”

and get our daily e-letter Investment Contrarians.

We respect your privacy!

We will never rent/sell your e-mail address.

That’s a promise! And you can opt out at any time.